[fusion_builder_container type=”flex” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” border_style=”solid”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” border_style=”solid” border_position=”all” spacing=”yes” background_repeat=”no-repeat” margin_top=”0px” margin_bottom=”0px” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”true” hover_type=”none” min_height=”” link=”” background_blend_mode=”overlay” first=”true”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”” rule_size=”” rule_color=”” hue=”” saturation=”” lightness=”” alpha=”” user_select=”” awb-switch-editor-focus=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” disable_idd=”no” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” html_attributes=”W10=” width_medium=”” width_small=”” width=”” min_width_medium=”” min_width_small=”” min_width=”” max_width_medium=”” max_width_small=”” max_width=”” margin_top_medium=”” margin_right_medium=”” margin_bottom_medium=”” margin_left_medium=”” margin_top_small=”” margin_right_small=”” margin_bottom_small=”” margin_left_small=”” margin_top=”” margin_right=”” margin_bottom=”” margin_left=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” font_size=”” line_height=”” letter_spacing=”” text_transform=”” text_color=”” render_logics=”” logics=”” animation_type=”” animation_direction=”left” animation_color=”” animation_speed=”0.3″ animation_delay=”0″ animation_offset=””]

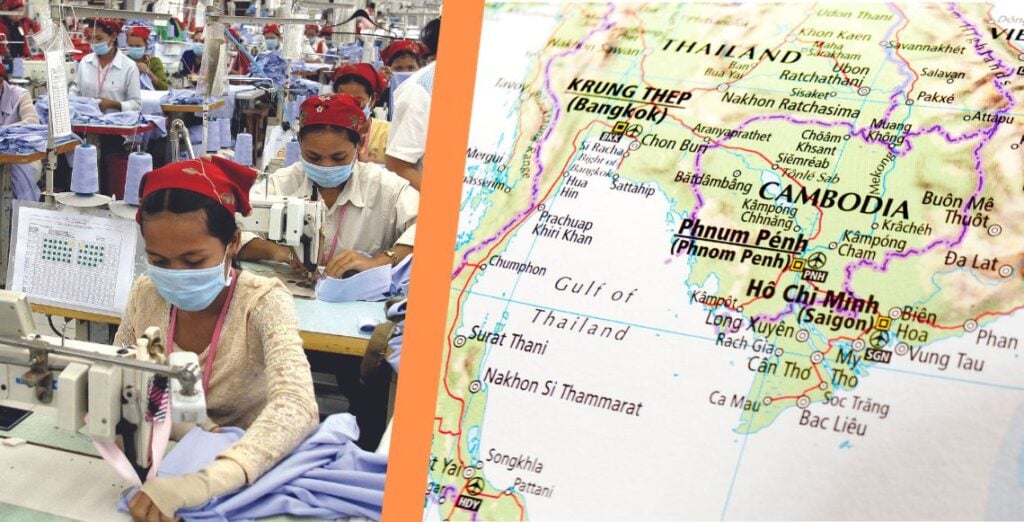

When Cambodia’s garment, textile, footwear, and travel goods exports surged to $14.83 billion in the first 11 months of 2025—a remarkable 17% year-over-year increase—it confirmed the Southeast Asian nation’s emergence as a significant player in global manufacturing. Yet this growth story carries complexity: over half of Cambodia’s 1,500+ factories are now Chinese-owned, representing $9 billion in investment aimed at circumventing US-China tariffs. For Western buyers evaluating Cambodia as a sourcing destination, understanding both the genuine opportunities and the tariff landmines defines success versus costly mistakes in 2025.

Cambodia’s Export Industries: Where Manufacturing Thrives

Cambodia’s manufacturing landscape concentrates heavily in specific sectors where the country has developed genuine capabilities and competitive advantages.

Garments and Textiles: The Dominant Sector

The garment industry represents Cambodia’s manufacturing backbone, accounting for approximately 62% of total merchandise exports and over one-third of GDP. With more than 1,500 factories employing 900,000 workers—predominantly women—the sector has grown consistently for three decades.

For Western apparel buyers, Cambodia offers several compelling advantages including labor costs of approximately $210 monthly (2026 minimum wage) significantly below China and competitive with Bangladesh, established quality systems serving global brands like H&M, Adidas, Levi’s, Under Armour, and Lululemon, preferential market access including duty-free treatment to the EU under Everything But Arms, and complete production capabilities from cutting through finishing and packaging.

Cambodia particularly excels in basic to mid-range garments including t-shirts, casual wear, and sportswear, knitted and woven apparel, footwear manufacturing with $1.9 billion exported in first 11 months of 2025 (up 26%), and travel goods and bags contributing $1.85 billion in exports.

However, buyers should understand Cambodia’s limitations. The country imports most textiles and fabrics from China, creating supply chain dependencies. Complex garments requiring advanced technical fabrics or intricate construction may exceed current capabilities. The industry faces capacity constraints with 116 new factories opening in H1 2025 unable to fully meet surging demand.

Footwear Manufacturing: Rapid Growth

Cambodia’s footwear sector experienced explosive 26% growth in 2025, reaching $1.9 billion in exports. Major global footwear brands have established production in Cambodia, creating an ecosystem of component suppliers and skilled workers.

For footwear buyers, Cambodia provides competitive pricing for athletic shoes, casual footwear, and work boots, established supply chains for soles, laces, and other components, quality capabilities meeting international brand standards, and growing capacity as new factories continue opening.

Travel Goods and Bags: Specialized Strength

With $1.85 billion in exports, Cambodia’s travel goods sector serves major retailers including luggage manufacturers, backpack and bag producers, and promotional products companies.

Electronics Assembly: Emerging Capabilities

While dwarfed by garment exports, Cambodia’s electronics assembly sector is growing as Chinese manufacturers relocate operations. Current capabilities include consumer electronics assembly, plastic component manufacturing, simple electronic accessories, and power adapter production.

For electronics buyers, Cambodia remains in early development stages. Complex products requiring sophisticated component ecosystems or advanced technical capabilities still require manufacturing in China, Vietnam, or Thailand. Cambodia makes sense for simple assembly operations or products where labor content significantly exceeds component costs.

The Chinese Factor: Tariff Mitigation Through Cambodian Production

Cambodia’s export surge cannot be understood without acknowledging the Chinese elephant in the room: over 50% of factories are now Chinese-owned, with approximately $9 billion in Chinese investment driven primarily by US tariff avoidance.

How Chinese Companies Use Cambodia

Chinese manufacturers facing 34% US tariffs have aggressively established Cambodian operations through several models including relocating entire production lines from China to Cambodian special economic zones, establishing new greenfield facilities in industrial parks spreading for miles, maintaining Chinese component sourcing while conducting final assembly in Cambodia, and Chinese management overseeing Cambodian workers in Chinese-owned factories.

One garment factory owner told CBS News he established Cambodian operations 20 years ago, but accelerated expansion when US-China trade tensions escalated. Many Chinese companies maintain dual production—factories in both China and Cambodia—allowing flexible sourcing based on tariff environments.

The Transshipment Concern and Regulatory Risk

This Chinese manufacturing presence creates significant risks for Western buyers. US authorities have become intensely focused on transshipment—goods merely routed through Cambodia with minimal transformation to evade Chinese tariffs.

The consequences are severe. In April 2025, the US Commerce Department imposed anti-dumping and countervailing duties as high as 3,521% on solar cells from Cambodia, finding they were essentially Chinese products with minimal Cambodian value-add. While solar represents an extreme case, it signals US willingness to impose punitive tariffs on products perceived as tariff evasion schemes.

For garments, the situation is complex. Cambodia’s entire manufacturing supply chain is “transshipment-adjacent” according to analysts—virtually all fabric and materials are imported from China, stitched in Cambodian factories (often Chinese-owned), then exported to Western markets. This describes normal supply chain operations, but could be characterized as transshipment by authorities seeking evidence.

The April 2025 Tariff Crisis

In April 2025, President Trump imposed a devastating 49% tariff on Cambodian imports, the highest rate imposed on any country, citing Cambodia’s role in Chinese tariff circumvention and its economic alignment with China following President Xi Jinping’s visit to Phnom Penh.

The tariff was subsequently paused until July 2025 as negotiations commenced, with Cambodia offering to reduce tariffs on US imports and enhance inspections of Chinese goods. However, the episode demonstrated Cambodia’s extreme vulnerability to US tariff policy shifts.

For Western buyers, this creates profound uncertainty. Products sourced from Cambodia face potential tariff rates that could eliminate any cost advantages overnight. Unlike USMCA-protected Mexico or countries with established free trade agreements, Cambodia has no structural protection against arbitrary tariff increases.

Strategic Considerations for Western Buyers

Given Cambodia’s opportunities and substantial risks, Western buyers should implement careful strategies when evaluating Cambodian sourcing.

When Cambodia Makes Sense

Cambodia remains viable and potentially advantageous for basic to mid-range garments where labor content is significant, footwear products where established manufacturing ecosystems exist, travel goods and bags leveraging specialized capabilities, and products already established in Cambodia where switching costs exceed tariff risks.

Buyers with high-volume, stable orders can justify the investment in qualifying Cambodian suppliers and developing production relationships. Companies already sourcing from Cambodia with proven suppliers should maintain relationships while monitoring tariff developments rather than panic-exiting.

When to Avoid or Proceed with Caution

Cambodian sourcing presents excessive risk for products where China remains the primary component source without genuine Cambodian transformation, high-value electronics or technical products where tariff percentages significantly impact economics, products requiring capabilities Cambodia lacks forcing compromise on quality or specifications, and new product launches where flexibility to shift production quickly matters more than absolute unit cost.

Implementing a China Plus Cambodia Strategy

Rather than viewing Cambodia as China replacement, sophisticated buyers implement China Plus Cambodia strategies where garments and labor-intensive products shift to Cambodia while components, technical products, or items requiring Chinese capabilities remain there, Chinese component sourcing continues while Cambodian factories add value through labor-intensive operations, and dual sourcing maintains production in both countries allowing rapid shifts based on tariff changes.

This approach acknowledges that Cambodia’s advantages come primarily from labor cost and market access, not from replacing China’s comprehensive manufacturing ecosystems.

Quality Control: Essential in Cambodia’s Developing Manufacturing Environment

Cambodia’s manufacturing sector, while growing rapidly, presents quality challenges requiring robust quality assurance programs.

Supplier Qualification and Factory Audits

Not all Cambodian factories operate at international standards. Many Chinese-owned facilities maintain Chinese management practices and quality systems, while Cambodian-owned factories vary dramatically in capability.

Before committing to Cambodian suppliers, implement comprehensive factory audits evaluating production capacity and equipment adequacy, quality management systems and documentation, workforce training and skill levels, and financial stability given tariff uncertainty threatening many operations.

Professional inspection companies including QIMA, Pro QC, Intertek, Bureau Veritas, HQTS, and V-Trust maintain networks in Cambodia capable of conducting factory capability assessments. Their local expertise helps identify capable suppliers while avoiding inadequate manufacturers.

Ongoing Quality Verification

Given Cambodia’s developing manufacturing capabilities and the prevalence of Chinese-owned operations potentially facing pressure to cut corners, ongoing quality control becomes essential through pre-shipment inspections on all Cambodian shipments without exception, during production monitoring for complex products or new supplier relationships, and container loading supervision ensuring correct products and quantities are shipped.

The investment in quality control services—typically $220-$350 per inspection—provides critical protection against quality failures that could devastate already-thin margins compressed by tariff pressures.

The Future Outlook: Uncertainty and Opportunity

Cambodia’s manufacturing future balances between opportunity and vulnerability.

Potential Tariff Normalization

If US-Cambodia negotiations succeed in reducing or eliminating the 49% tariff threat, Cambodia’s garment and footwear sectors could experience explosive growth. The country’s labor cost advantages, preferential EU access, and established manufacturing base create genuine competitiveness when tariffs don’t distort economics.

Risk of Permanent High Tariffs

Conversely, if the US permanently maintains high tariffs viewing Cambodia as a Chinese proxy, the country’s export-dependent economy faces crisis. Factory closures, worker layoffs, and economic contraction would follow, making Cambodia an unstable sourcing destination.

Diversification Beyond Chinese Ownership

Cambodia benefits if it can attract non-Chinese foreign investment and develop indigenous manufacturing capabilities. Western brands directly investing in Cambodian facilities rather than sourcing through Chinese intermediaries could help Cambodia shed its transshipment image.

Calculated Cambodian Sourcing in an Uncertain Environment

Cambodia offers Western buyers genuine manufacturing capabilities in garments, footwear, and travel goods at competitive prices with preferential market access to key regions. The country’s 900,000-worker garment sector, $14.83 billion export performance, and continuing growth demonstrate real industrial capacity.

However, Cambodia’s heavy Chinese manufacturing presence, vulnerability to US tariff policy shifts, and transshipment concerns create substantial risks. The 49% tariff threat—even if temporarily paused—demonstrates how quickly sourcing economics can invert.

For Western buyers, success requires strategic product selection focusing on Cambodia’s strength categories, comprehensive due diligence verifying genuine Cambodian manufacturing versus Chinese transshipment, robust quality control programs protecting against variable supplier capabilities, contingency planning enabling rapid shifts if tariffs escalate, and realistic expectations acknowledging Cambodia’s developing capabilities and inherent limitations.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]