[fusion_builder_container type=”flex” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” border_style=”solid”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” border_style=”solid” border_position=”all” spacing=”yes” background_repeat=”no-repeat” margin_top=”0px” margin_bottom=”0px” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”true” hover_type=”none” min_height=”” link=”” background_blend_mode=”overlay” first=”true”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”” rule_size=”” rule_color=”” hue=”” saturation=”” lightness=”” alpha=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” margin_top=”” margin_right=”” margin_bottom=”” margin_left=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” font_size=”” line_height=”” letter_spacing=”” text_transform=”” text_color=”” animation_type=”” animation_direction=”left” animation_color=”” animation_speed=”0.3″ animation_delay=”0″ animation_offset=”” logics=””]

When the first wave of US tariffs on Chinese goods hit in 2018, manufacturers worldwide faced a critical decision: absorb escalating costs or relocate production to alternative countries. In the first half of 2019, Vietnam’s trade surplus with the U.S. rose 39% to $25.3 billion, signaling a massive shift in global manufacturing that would transform Vietnam from a frontier market into one of Southeast Asia’s most dynamic industrial economies.

For importers sourcing mechanical parts, consumer goods, electronics, furniture, or garments, understanding how Vietnam capitalized on the trade war—and the opportunities and challenges this creates for your supply chain diversification strategy—has become essential for competitive positioning in 2025 and beyond.

Vietnam’s Strategic Position as China’s Primary Alternative

Vietnam’s transformation into a global tech manufacturing hub started in 2008 when Samsung broke ground for its first smartphone factory, laying groundwork that would prove invaluable a decade later. When trade tensions escalated in 2018, Vietnam possessed three critical advantages that positioned it as the natural destination for manufacturers fleeing China.

Geographic Proximity to China

Vietnam shares a land border with China and sits at the heart of Southeast Asian shipping routes. Vietnam’s closer proximity to China, along with its location in the ASEAN region, allows manufacturers to sell and move equipment quicker across the border. This proximity enables companies to maintain relationships with Chinese component suppliers while establishing assembly operations in Vietnam—a crucial advantage for complex products dependent on extensive supply chains.

For electronics manufacturers, proximity means shorter lead times for components. For furniture producers, it facilitates access to Chinese hardware and materials while final assembly occurs in Vietnam. This hybrid model allows companies to leverage China’s unmatched component ecosystem while benefiting from Vietnam’s tariff advantages.

Competitive Labor Costs

Rising wages in China had already been pushing labor-intensive manufacturing toward lower-cost alternatives before the trade war accelerated the trend. Vietnam’s wages tend to be low at US$132 to US$190 per month depending on the region, as compared to US$163 to US$361 in China, creating compelling economics for industries like garments, footwear, furniture assembly, and basic electronics manufacturing.

For apparel importers, Vietnam’s cost advantage in cutting and sewing operations delivers immediate margin improvements. For mechanical parts requiring significant manual finishing, labor cost differentials translate directly to bottom-line savings. However, these advantages come with the caveat that Vietnam’s wages are rising as demand for workers intensifies.

Favorable Trade Agreements

Vietnam’s proactive approach to trade liberalization positioned the country to capitalize on trade war disruptions. Vietnam signed a free trade deal with the EU in 2019, an agreement with the UK in 2020 and joined the Comprehensive and Progressive Agreement for Trans-Pacific Partnership when it was created in 2018. These agreements provide preferential access to major consumer markets that China doesn’t enjoy, creating tariff arbitrage opportunities.

For importers serving European markets, products manufactured in Vietnam face lower duties than Chinese alternatives. The CPTPP provides similar advantages for Canadian, Australian, and Japanese markets. Understanding these trade agreement benefits helps optimize total landed costs when evaluating Vietnam as a sourcing destination.

Electronics and High-Tech Manufacturing Boom

The electronics sector exemplifies Vietnam’s transformation from basic assembly to sophisticated manufacturing capabilities.

Major Global Investments

Today, most Samsung smartphones are made in Vietnam. Apple has moved production of iPads, MacBooks, AirPods, and Apple Watches to the country, while other big names like Foxconn, Nintendo, Lenovo, Luxshare, Goertek, and Pegatron have opened new factories. This concentration of major brands validates Vietnam’s electronics manufacturing ecosystem and creates opportunities for component suppliers.

Vietnam’s electronics industry is projected to reach over US$169 billion in revenue by 2025, driven by strong exports and FDI inflows, demonstrating the sector’s explosive growth trajectory. For importers of consumer electronics, power adapters, cables, or electronic accessories, Vietnam has developed comprehensive capabilities that rival China in many product categories.

Semiconductor Industry Development

Vietnam isn’t stopping at assembly operations. Vietnam’s semiconductor industry has reached a critical inflection point in 2025. Propelled by multi-billion-dollar foreign direct investments, the rise of capable local firms, and comprehensive government backing, the country is rapidly evolving from a manufacturing satellite into a strategically positioned node within the global semiconductor ecosystem.

Companies like Intel, Amkor Technology, and Samsung operate large-scale semiconductor assembly and testing facilities in Vietnam. For importers of products requiring integrated circuits or electronic components, Vietnam’s growing semiconductor capabilities mean more of the supply chain can be localized within the country, reducing dependence on cross-border component flows.

Garments and Textiles: Traditional Strength Amplified

In 2010, Vietnam surpassed China for the first time as the leading producer of Nike shoes, demonstrating capabilities that would attract the entire apparel industry when trade pressures mounted.

Established Infrastructure and Expertise

Vietnam had spent decades building textile and garment manufacturing expertise serving global brands. When US tariffs on Chinese apparel escalated, importers found Vietnam ready to absorb increased orders without the learning curve required in less developed alternatives.

Vietnamese imports into the US increased in garments, textiles, furniture and dried fish, which was previously processed in China for consumption in the US before Trump’s tariffs hikes. For fashion brands and apparel importers, Vietnam offers complete vertical integration from fabric production through cut-and-sew operations to finished garment packaging.

Specialized Capabilities by Garment Category

Vietnam excels particularly in athletic wear, technical fabrics, footwear manufacturing, and outdoor apparel. For importers in these categories, Vietnam’s specialized workforce and established quality systems often deliver better results than attempting to develop new suppliers in alternative countries.

However, Vietnam faces capacity constraints in certain niche categories. Intimate apparel, highly embellished garments, and certain technical outdoor products may still require Chinese manufacturing expertise. Understanding these capability gaps helps set realistic expectations when evaluating Vietnam for specific product lines.

Furniture Manufacturing Expansion

The furniture sector represents another Vietnam success story accelerated by trade tensions.

Wood Furniture Strengths

Vietnam’s abundant timber resources, skilled woodworking tradition, and established furniture manufacturing base made it the natural destination for furniture importers seeking China alternatives. From bedroom sets to outdoor furniture, Vietnam has developed comprehensive capabilities across furniture categories.

For importers of wood furniture, Vietnam offers advantages in raw material access, competitive pricing, and established export infrastructure. The country’s furniture manufacturers have invested in modern equipment, finishing capabilities, and packaging systems that meet international standards.

Upholstered Furniture and Outdoor Products

Beyond wood furniture, Vietnam has rapidly developed capabilities in upholstered furniture, outdoor furniture, and furniture requiring metal components. While some complex mechanisms or specialized materials may still source from China, final assembly and finishing operations have successfully transitioned to Vietnam.

Mechanical Parts and Industrial Components

While less publicized than consumer goods, mechanical parts manufacturing has also grown significantly in Vietnam.

CNC Machining and Metal Fabrication

Vietnam’s industrial base includes capable CNC machining operations, stamping facilities, and metal fabrication workshops serving automotive, industrial, and consumer product sectors. For importers of mechanical components, Vietnam offers cost advantages compared to China while maintaining acceptable quality levels for many applications.

High-precision aerospace components or medical device parts may still require Chinese or other manufacturing locations with more advanced capabilities. However, for general industrial parts, automotive aftermarket components, or consumer product mechanical elements, Vietnam increasingly provides viable alternatives.

Assembly Operations for Complex Products

Even when individual components continue to source from China or other countries, Vietnam excels at assembly operations that add value through integration. Products requiring significant manual assembly benefit from Vietnam’s cost-competitive labor while leveraging global component supply chains.

The Challenges Vietnam Faces

Vietnam’s rapid growth as a manufacturing destination hasn’t been without obstacles that importers must understand and navigate.

Infrastructure Constraints

There are other challenges for a fast-growing manufacturing base like Vietnam, including the risk that its port capacity and customs staff could be overwhelmed by surging orders. Port congestion, power supply limitations, and transportation bottlenecks can cause delays that offset cost advantages.

For importers with tight delivery schedules, Vietnam’s infrastructure limitations require buffer time in production planning. Working with suppliers in industrial zones with dedicated infrastructure helps mitigate some challenges.

Rising Tariff Scrutiny

Vietnam’s success hasn’t gone unnoticed by trade authorities. Concerns about transshipment—where Chinese products are relabeled as Vietnamese to evade tariffs—have led to increased scrutiny. On that basis, just 1.8 percent, or $1.7 billion, of goods were likely to have been rerouted in 2021, suggesting legitimate manufacturing rather than widespread fraud, but heightened enforcement remains a factor.

For importers, ensuring genuine Vietnamese manufacturing with proper country-of-origin documentation is essential. Third-party inspections that verify actual production in Vietnam protect against customs complications.

Competition for Manufacturing Capacity

By mid-2023, a global demand slump hit Vietnam’s assembly lines hard, leading to major job cuts. More than 45,000 workers lost jobs in the first five months of 2023. The volatility in demand coupled with intense competition for qualified suppliers means importers can’t assume capacity is always available.

Building relationships with multiple Vietnamese suppliers and maintaining China backup options helps manage capacity risks. Early booking of production slots during peak seasons becomes more critical in capacity-constrained markets.

Practical Considerations for Sourcing from Vietnam

For importers considering Vietnam as part of China Plus One strategies, several practical factors deserve attention.

Product Category Fit Assessment

Not all products transition equally well to Vietnam. Evaluate your products against Vietnam’s demonstrated strengths in electronics assembly and components, garments and footwear, furniture and home goods, mechanical parts requiring moderate precision, and products with high labor content.

Products requiring specialized materials only available in China, extremely tight tolerances, or small volumes may not justify the transition effort and supplier development investment required.

Supplier Qualification Requirements

Vietnamese suppliers vary dramatically in capability, quality systems, and reliability. Vietnam’s role in supply chains has grown so much that trade and economic policy choices could become increasingly difficult to make, as Hanoi refuses to take sides. Thorough supplier qualification including comprehensive factory audits, production capacity verification, quality management system assessment, and financial stability evaluation becomes essential.

Professional inspection companies like QIMA, ProQC, HQTS, and V-Trust maintain strong networks in Vietnam and can conduct factory audits to verify supplier capabilities before committing to production. Their local presence enables responsive service as you build your Vietnam supply base.

Quality Control Programs

Never assume Vietnamese suppliers operate at the same quality levels as established Chinese partners. Implement robust quality control including first article inspections before mass production, during production monitoring for complex or high-value orders, pre-shipment inspections using appropriate AQL standards, and container loading supervision to prevent damage and shortages.

Independent third-party inspection services provide objective verification that protects against quality problems while suppliers demonstrate consistent performance.

Realistic Timeline Expectations

The transition has faced challenges, including supply chain bottlenecks in Vietnam, resulting in a 10% increase in lead times for some products. Plan for extended timelines when establishing Vietnam sourcing including three to six months for supplier identification and qualification, six to twelve months for tooling, sampling, and approval cycles, and twelve to twenty-four months to reach stable, mature production relationships.

Companies expecting quick transitions often face disappointment. Those planning multi-year programs with realistic milestones set themselves up for success.

The Future Outlook for Vietnam Manufacturing

Vietnam’s role in global manufacturing will continue evolving as the country addresses current limitations and builds new capabilities.

Continued Foreign Investment

Major corporations continue investing billions in Vietnam facilities, validating the country’s long-term potential. For importers, this ongoing investment signals that Vietnam’s manufacturing capabilities will continue advancing rather than stagnating.

Skills Development and Automation

To address rising labor costs and skills gaps, Vietnamese manufacturers are investing in automation and workforce training. These improvements will enable more sophisticated manufacturing over time, though also gradually erode some cost advantages.

Trade Agreement Expansion

Vietnam continues pursuing additional trade agreements that enhance market access. For importers serving global markets, Vietnam’s expanding trade agreement network creates strategic advantages that compound over time.

Conclusion: Vietnam as Strategic Supply Chain Component

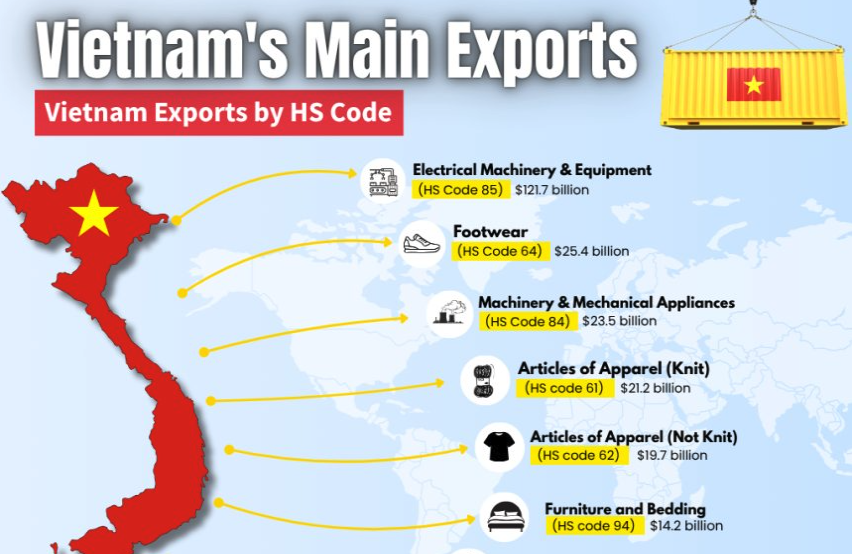

Vietnam has unquestionably benefited from the US-China trade war, transforming from a frontier economy into a critical node in global manufacturing networks. For importers of mechanical parts, electronics, furniture, garments, and consumer goods, Vietnam now offers viable alternatives to Chinese manufacturing in many product categories.

However, success in Vietnam requires understanding both opportunities and limitations. Not all products transition smoothly. Supplier qualification demands careful attention. Infrastructure constraints and capacity competition create operational challenges. Quality control can’t be assumed—it must be verified.

The most successful approach treats Vietnam as a strategic component of diversified supply chains rather than a wholesale China replacement. Maintain production in both countries based on each product’s requirements and each country’s comparative advantages. Implement professional quality control and supplier management programs to ensure Vietnam operations deliver the cost savings and risk mitigation they promise.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]